Digital Banking Solutions for your corporate customers

The requirements for digital banking solutions for corporate customers and the required level of integration on the company side have increased significantly in recent years. The majority of banking solutions currently offered by banks can no longer meet these requirements. Banks are not system integrators who should be able to implement this kind of thing into an infrastructure that has become increasingly complex.

What distinguishes our digital banking software ennoxx.banking

Modern & device-independent UI

Our web-based, responsive UI can be used on almost any device. Intuitive use and data processing is joined by simple selection, sorting, filtering, grouping and exporting.

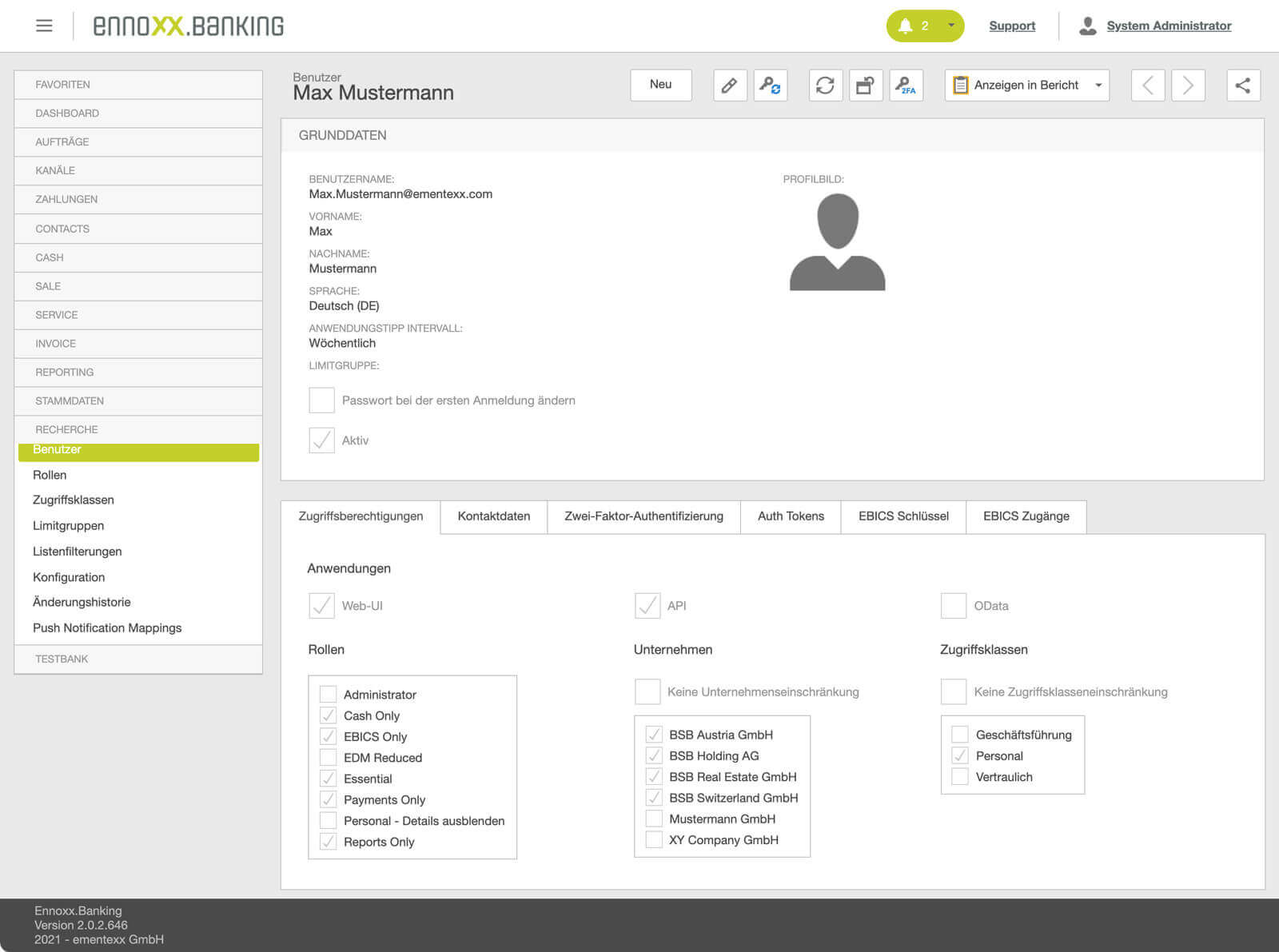

Multi-client capable & secure

The multi-client capability combined with a comprehensive role and security concept allows finely-grained authorisation granting for companies, accounts, access classes, etc. down to the field level.

Able to be integrated & automated

In order to automate the processes in your company in a way that makes the most sense, ennoxx.banking offers different interfaces. This includes different types of connectivity and data transformation options through to your own banking API.

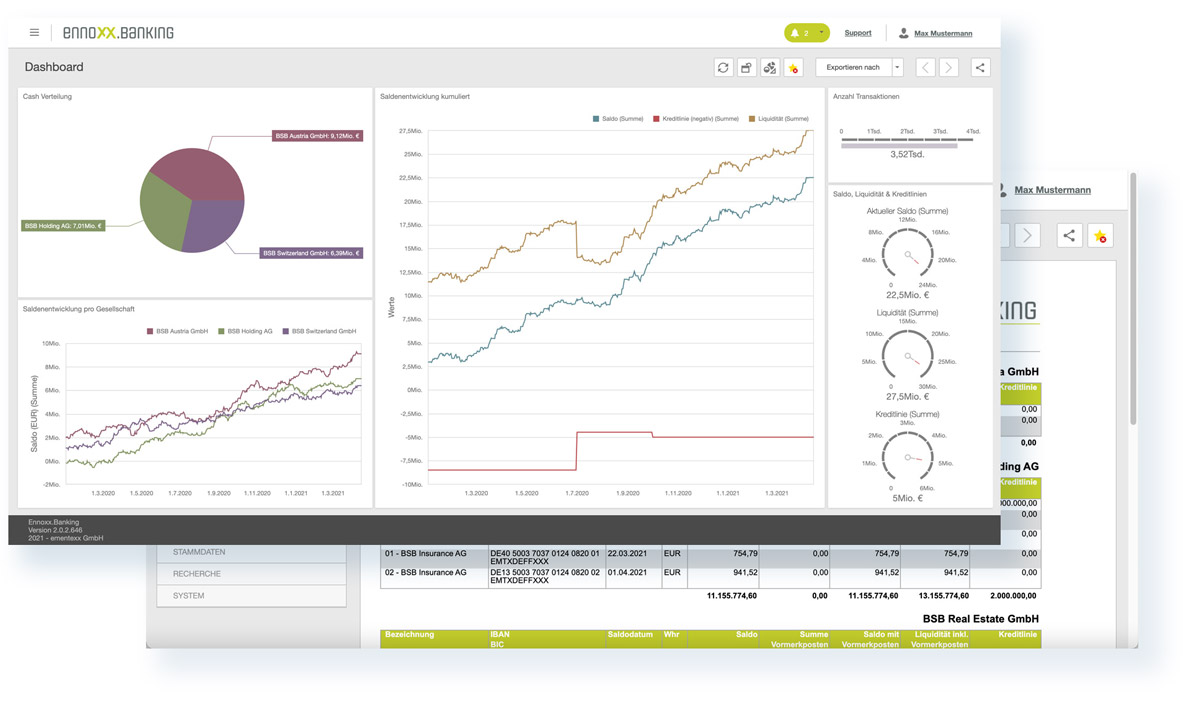

Reporting & dashboards

All essential KPIs and data can be viewed at a glance using the customisable dashboards and reports. In addition, ennoxx.banking can be integrated into in-house business intelligence tools.

Procurement and white-Label

With our range of solutions and associated services, you as the bank are able to offer your corporate customers a modern digital banking solution that meets the highest requirements.

This can either be as an intermediary for the products we offer or as a white-label version adapted to your institution.

We will, of course, handle the migration of the company’s previously used solution and take on further technical support.