With the Forecast functionality it is possible to display and manage expected future account movements and to include them in various calculations ( balances development etc.).

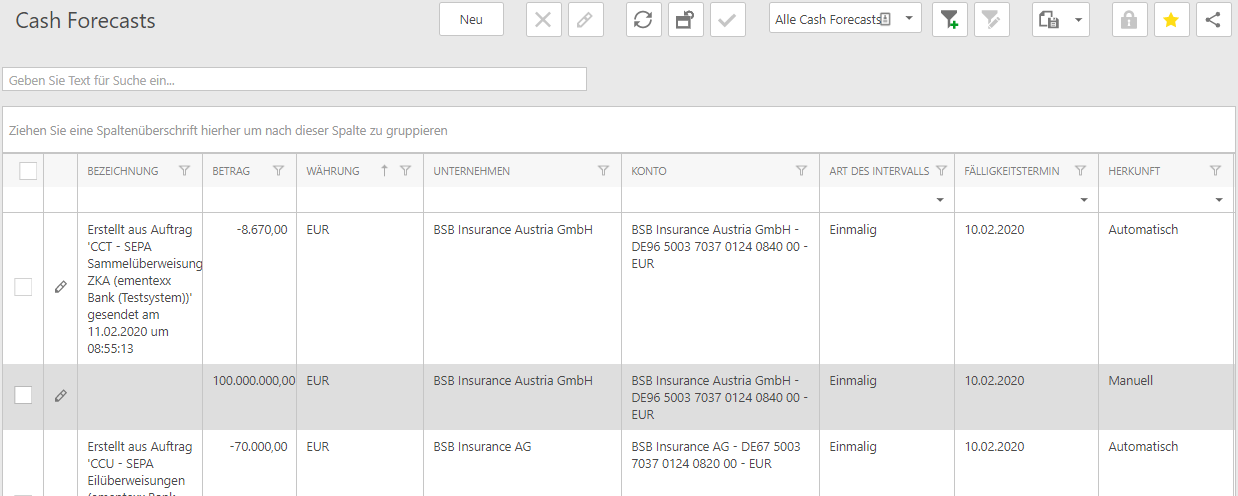

Basically, a distinction is made between manual and automatic forecast data. Automatic planning data can be generated from payments entered in ennoxx.banking or payment jobs from backend systems (financial accounting). It does not matter whether the payments are imported or directly set as EBICS send jobs.

Other sources of forecast transactions can be incoming invoices, outgoing invoices, sales jobs and service jobs (modules depending on the scope of the license).

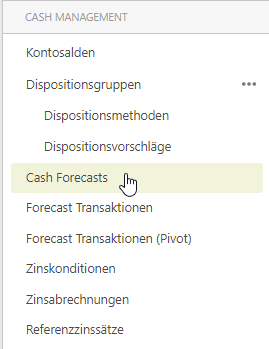

Menu/Navigation

You will find the menu items for the forecast under the heading "CASH MANAGEMENT".

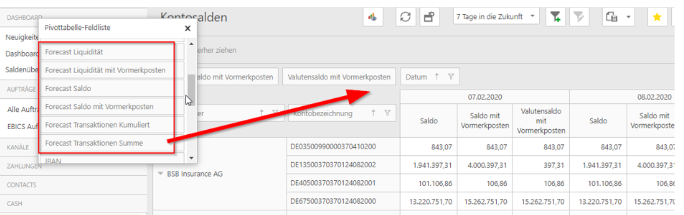

In the account balances area, corresponding forecast fields are available and can be included in the pivot table depending on the desired calculation modality.

Capture/Generation

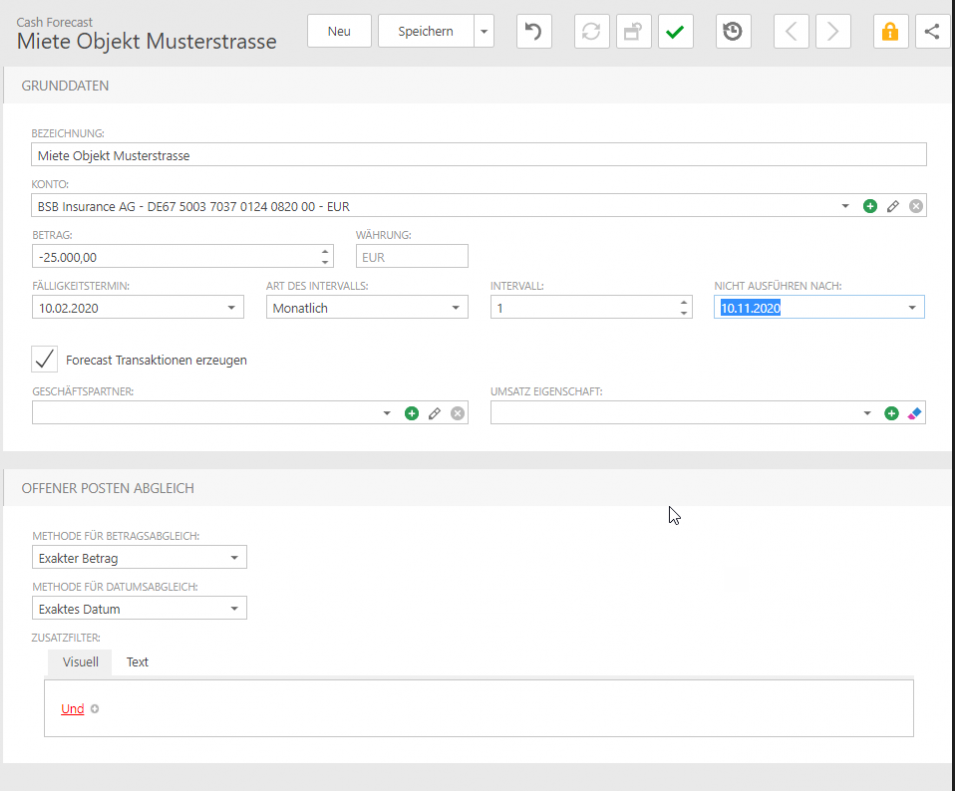

The entry offers the possibility to create or generate both one-time or periodically recurring forecast transactions.

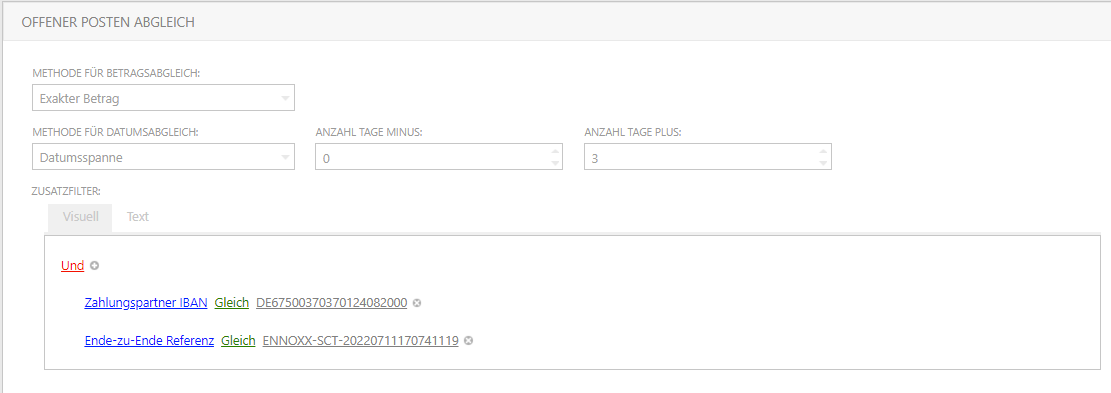

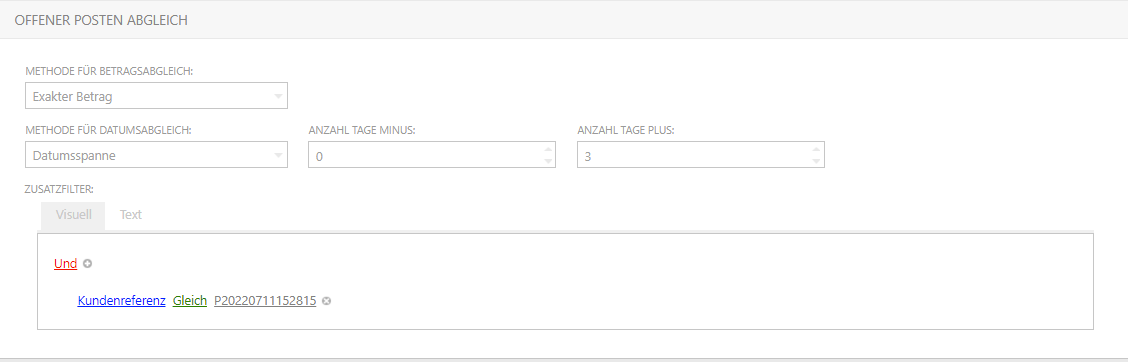

Für einen effektiven Abgleich der offenen Posten ist zudem die Vorgabe der Methode für Betrags- und/oder Datumsabgleich möglich, ebenso die Nutzung zusätzlicher Filter. Sollte die Zahlung einen in ennoxx.banking hinterlegten Geschäftspartner betreffen, kann darauf referenziert werden.

For an effective reconciliation of the open items, it is also possible to specify the method for amount and/or date reconciliation, as well as the use of additional filters. If the payment concerns a payment partner stored in ennoxx.banking, it can be referred to.

In addition, if the payment is an internal payment (both accounts exist in the master data/accounts), a cash forecast/forecast transaction is generated not only for the outgoing payment, but also for the incoming payment on the recipient account.

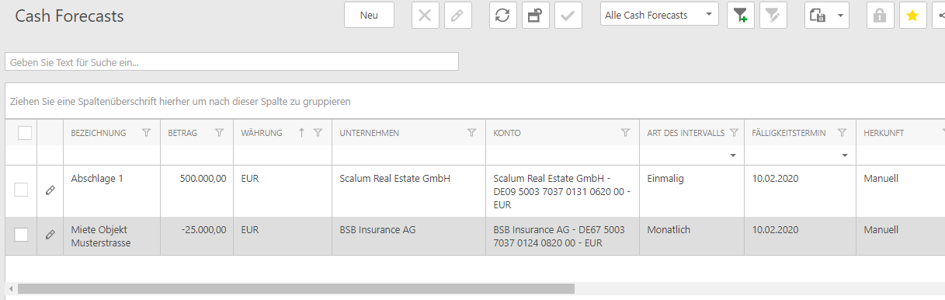

Overview - Cash Forecast

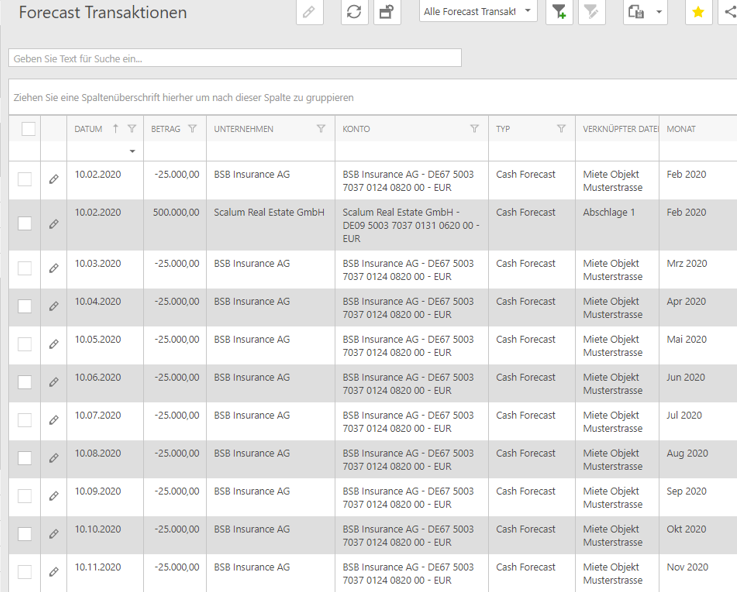

Overview - generated Forecast Transactions

Overview - Forecast Transactions (Pivot)

Overview - Account Balances (example)

Reconciliation

A reconciliation is always performed against the current position in the cash forecast. The movements can be reconciled manually or automatically.

Manual Reconciliation

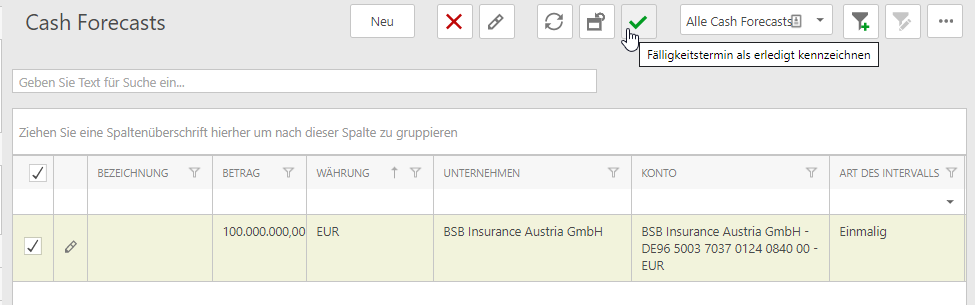

Here, only the affected data records have to be marked and matched via the button "Mark due date as done". If it is a recurring forecast, the next due transaction will be set/displayed. Reconciled cash forecasts are deleted. It is not possible to reactivate or restore them. If there is also a forecast transaction for a cash forecast, this will also be deleted.

Automatic Reconciliation

Automatic reconciliation takes place after the successful fetching of advice transactions or account information.

For the matching of advice transactions or account transactions with the plan data record, certain rules and filters are required. For automatically generated cash forecasts, Amount Method = Exact Amount and Date Matching Method = Date Range 0/3 are fixed. The additional filter is set by default to payment partner IBAN and end-to-end reference, or to the customer reference (Payment Info ID). This depends on whether the payments are batch or single payments and whether an existing recipient/payment partner can be referenced in the system.

The transfer date is used for the matching. However, if the execution date in the payment file is higher, this will be used for the matching.