According to the DFÜ Agreement Annex 3, the SEPA End-To-End ID identifies each individual transaction. It is passed through the entire chain and is also provided when payments are returned. The use and unique assignment has the following advantages for the creditor:

- Unique attribute in the communication with the creditor of a SEPA Direct Debit

- Reference in case of complaint to his bank

- Assignment criterion for returns

The SEPA End-To-End ID is displayed on the creditor's account statement.

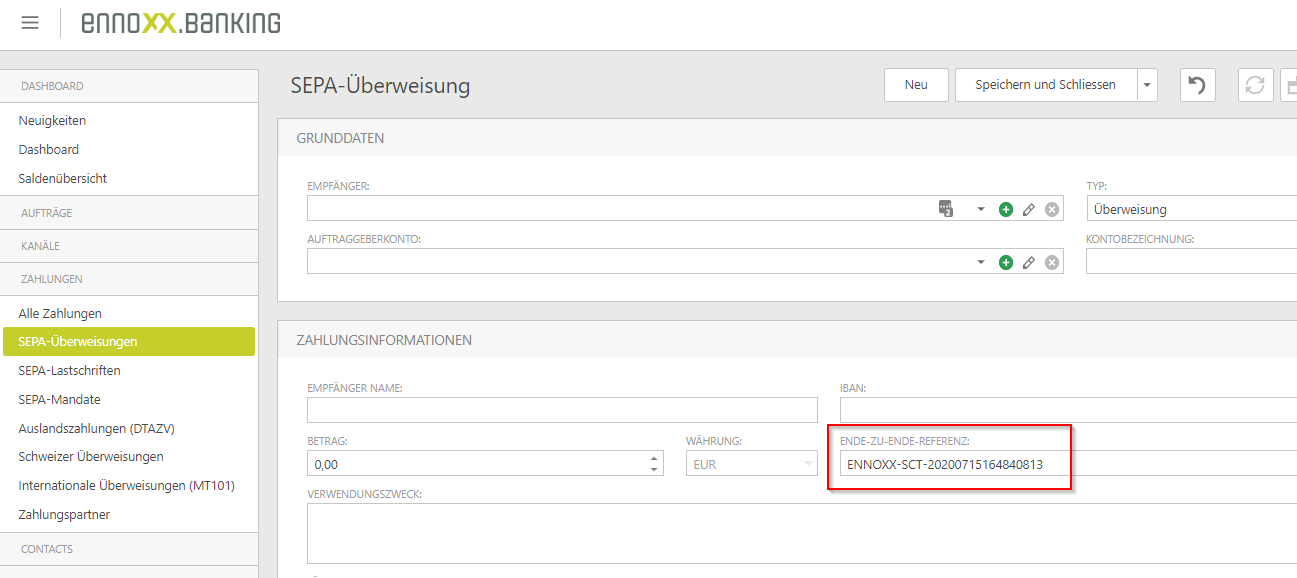

In ennoxx.banking, the structure or syntax of the end-to-end ID to be generated by the system can be specified under "SYSTEM - CONFIGURATION (1)" under the tab "Payments"(2). It is possible to store different definitions for SEPA credit transfers, SEPA direct debits and Swiss credit transfers (3). It is also possible to specify whether the field assignment is mandatory (according to the format definition, the assignment is optional).

When entering a new payment, the field will then be preset accordingly.

The input is limited to 35 characters. If the field is not occupied, but is set as a mandatory field, the payment cannot be saved. A manual change/overwriting of the End-To-End-ID generated by the system is possible at any time.